Organized by E-Justice India Online Law School

Instructor: Adv. Devanshi Bajpai (Delhi High Court)

About the Course

Alternative Dispute Resolution (ADR) is becoming the preferred method for resolving high-stake financial, corporate, and cross-border disputes. This certificate course introduces participants to the structure, application, and advanced concepts of ADR in the financial sector, covering banking, insurance, and international investment matters.

The course has been meticulously designed to prepare students and professionals for practical and policy-level understanding of the evolving ADR landscape in India and globally.

Course Structure

MODULE 1: INTRODUCTION

MODULE 2: CONCEPTUAL AND LEGAL FRAMEWORK OF ADR

2.1 Definition and Principles of ADR

2.2 Historical Development of ADR in Financial Disputes

2.2.1 Introduction: Evolution of ADR in Financial Disputes

2.2.2 ADR in Ancient India: The Vedic and Post-Vedic Era

2.2.3 ADR in the Medieval Period: Islamic and Mughal Influence

2.2.4 British Colonial Era: Institutionalizing Arbitration

2.2.5 Post-Independence Reforms

2.2.6 Global Influence and Recent Reforms

2.3 Comparison Between ADR and Litigation

2.4 Types of ADR Mechanisms

2.5 Significance of ADR in Cross-Border Financial Conflicts

2.5.1 Advantages of ADR in Cross-Border Financial Disputes

2.5.2 Key Developments in ADR and Cross-Border Disputes

2.6 National Legal Frameworks for ADR

2.6.1 Arbitration as a Legal Tool

2.6.2 Mediation as a Structured ADR Mechanism

2.6.3 Conciliation as a Proactive Dispute Resolution Approach

2.7 International Conventions and Treaties on ADR

MODULE 3: ADR AND CORPORATE BANKING & INSURANCE SECTOR DISPUTES

3.1 Nature and Types of Corporate Banking & Insurance Disputes

3.1.1 Corporate Banking Disputes

3.1.2 Insurance Sector Disputes

3.2 Role of ADR in Resolving Corporate Banking Disputes

3.3 Role of ADR in Resolving Insurance Disputes

3.4 Challenges and Limitations of ADR in Corporate Banking & Insurance Sector

MODULE 4: ADR AND INTERNATIONAL INVESTMENT DISPUTES

4.1 Overview of International Investment Conflicts

4.2 Role of BITs and ADR

4.2.1 Historical Background of BITs

4.2.2 India’s Entry and Early BIT Framework

4.2.3 BITs and ADR: A Symbiotic Relationship

4.3 Investment Arbitration under ICSIDS

4.3.1 Jurisdictional Foundations of ICSID

4.3.2 ICSID Case Studies

4.3.3 Statistical Trends for 2024

4.3.4 Basis of Consent for Jurisdiction

4.3.5 Geographical Distribution of Cases

4.3.6 Sectorial Distribution of Cases

4.3.7 Procedural Advantages of ICSID

4.3.8 Criticism and Challenges

4.4 Challenges in Implementing ADR in Investment Disputes

MODULE 5: COMPARATIVE ANALYSIS OF ADR ACROSS SECTORS

5.1 Procedural Approaches in ADR Across Sectors

5.1.1 Corporate Banking

5.1.2 Insurance

5.1.3 International Investment

5.2 Legal Standards Across Jurisdictions in Sectors: Comparison between India, U.K., U.S and EU

5.2.1 Corporate Banking

5.2.2 Insurance

5.2.3 International Investme

MODULE 6: ADR IN CROSS-BORDER FINANCIAL DISPUTES AND FUTURE ROADM

6.1 Sectorial Impact of ADR in Cross-Border Financial Dispute

6.1.1 ADR in Corporate Banking Sector

6.1.2 ADR in Insurance Sector

6.1.3 ADR in International Investment Sector

6.2 Common Challenges

6.3 Emerging Trends in ADR in Cross Boarder Financial Dispute

6.3.1 Online Dispute Resolution (ODR): Bridging Borders Virtually

6.3.2 AI-Powered Dispute Analytics and Predictive Tools

6.3.3 Block Chain and Smart Contracts in ADR

6.3.4 Green Arbitration and Sustainable ADR

6.3.5 Hybrid Dispute Resolution Models

6.4 Institutional Innovations and Rules Revision

6.5 Towards a Global ADR Framework: Future Road Map and Strategic Suggestions

Eligibility

Open to Law Students and Legal Professionals.

Mode of Learning

- Module-Based Learning

- Live Sessions + Study Material (Accessible to Registered Participants Only)

- Final Online Examination (MCQs – 50 Questions, 2 Marks Each)

- Minimum Passing: 30%

Perks for Participants

✅ Certificate of Completion

✅ Notes, E-Books & Quizzes

✅ Live Interactive Sessions

✅ Special AMA with Experts

✅ Publication Opportunity

✅ Letter of Recommendation (Top Performers)

✅ Guaranteed Internship (Online) at Tier 1 & Tier 2 Law Firms (Top Performers)

Course Fee

The course fee is INR 2500 INR 499 Only /- (Non-Refundable)

Payment & Registration

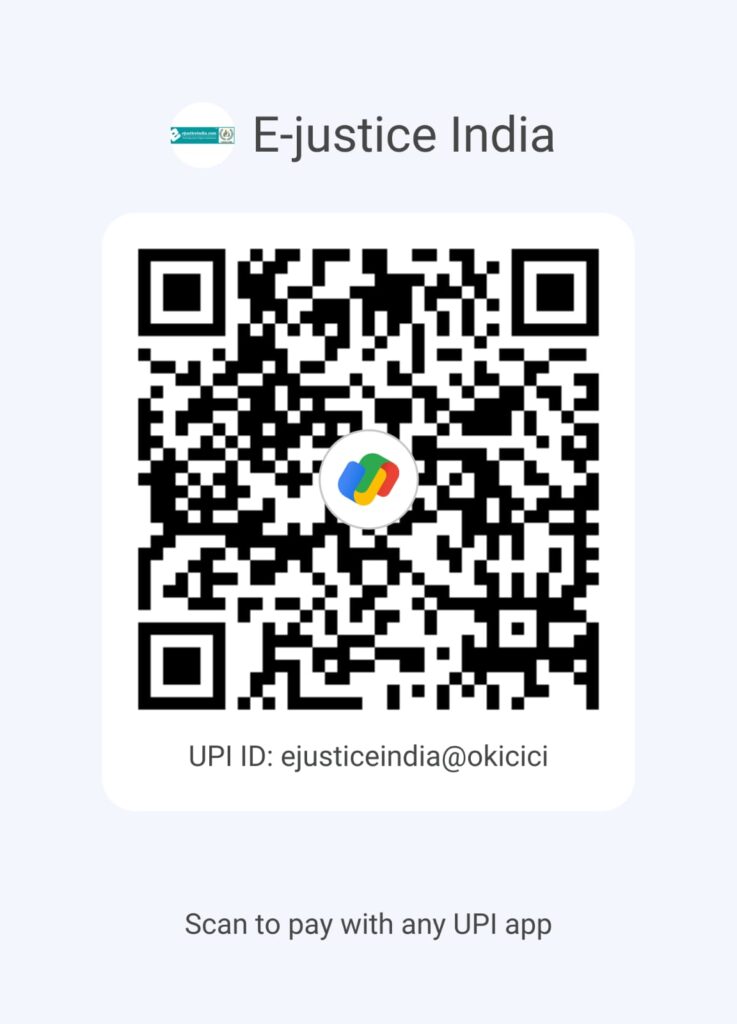

Participants have to pay through UPI ID given below and then register themselves. After the Payment, all participants need to upload screenshot of the same while Registration.

UPI ID – ejusticeindia@okicici

or Scan the below scanner

Registration Details

Last Date to Register: 28th August 2025

Starts From : 01st September 2025

Registration Form Link: Click Here to Register

Email: courses@ejusticeindia.com